Financial Aid: Frequently Asked Questions

-

- How do I get a tax transcript for a prior year tax return?

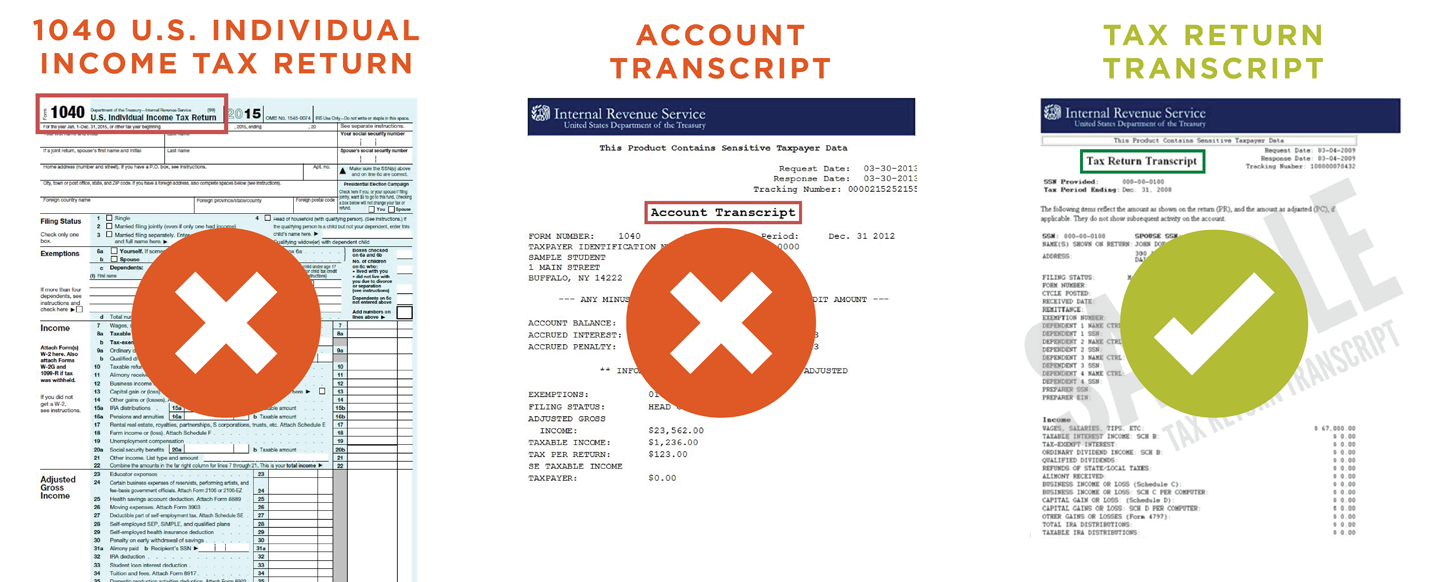

You can request your Tax Transcript to either be mailed to you or you can print your Tax Transcript online by visiting https://www.irs.gov/individuals/get-transcript. If you are unfamiliar with what an IRS Tax Transcript looks like, refer to the image below for clarification:

What is the difference between a tax transcript and a tax return?

- What are the Financial Aid Application Deadlines?

Federal and State Aid for US Citizens and Permanent Residents

Applying for Financial AidWhat is a Cal Grant?What is a Loan?What is a Federal Work Study Job?Aid Type Application Due Date Videos Pell, SEOG, CCPG (Fee Waiver) FAFSA 2019-2020 FAFSA

Apply from 10/1/2018 to 6/30/2020

2020-2021 FAFSA:

Apply from 10/1/2019 to 6/30/2021Applying for Financial Aid

Cal Grant FAFSA Priority Deadline:

March 2nd!What is a Cal Grant? Direct Loans FAFSA 2019-2020 FAFSA

Apply from 10/1/2018 to 6/30/2020

2020-2021 FAFSA:

Apply from 10/1/2019 to 6/30/2021What is a Loan? Federal Work Study (FWS) FAFSA and FWS 2019-2020 FAFSA

Apply from 10/1/2018 to 6/30/2020

2020-2021 FAFSA:

Apply from 10/1/2019 to 6/30/2021What is a Federal Work Study Job? State Aid for Undocumented Students and AB540 Students

What is a Cal Grant?What is the California College Promise Grant?Aid Type Application Due Date Videos Cal Grant CA Dream Act Priority Deadline:

March 2nd!What is a Cal Grant? CCPG (Fee Waiver) CA Dream Act 2019-2020 CA Dream Act

Apply from 10/1/2018 to 6/30/2020

2020-2021 CA Dream Act:

Apply from 10/1/2019 to 6/30/2021What is the California College Promise Grant? - I have a red flag asking me for an IRS tax transcript, I didn't file - what do I do?

When completing the required verification worksheet (additional red flag), in the section titled "Income Tax Information", mark the appropriate box for non-tax filers. Once this worksheet is received by the Financial Aid Office, the flag asking for an IRS tax transcript will be updated to reflect your tax-filing status.

I was asked to verify that I did not file a Federal income tax return. How do I do this?

- I've filed my FAFSA/Dream Act Application for the current year, what happens next?

Log into your Mt. SAC Portal and click on the "Financial Aid Tab". Check your financial aid status by clicking on "Financial Aid Status". By clicking on “Financial Status”, you will have access to view detailed information regarding the status of your financial aid, including the following: Satisfied Requirements and Unsatisfied requirements – documents needed to complete your file. Promptly submit required documents in the drop box located next to counter number 1 (one) of the Financial Aid Office.

What is the CA Dream Act?

For specific instructions, visit the Viewing Your Award Status page. - Do I have to fill out a FAFSA or CA Dream Act Application to get financial aid?Yes, all financial aid programs, require the Free Application for Federal Student Aid (FAFSA) or CA Dream Act Application (CADAA). Students who only want to apply for a fee waiver, can fill out a simpler form, but we recommend that such students also fill out a FAFSA or CADAA to apply for other aid.

- When should I file my FAFSA or CA Dream Act Application?You should file your FAFSA or CA Dream Act Application every year between October 1st and March 2nd (the priority Cal Grant deadline) for the following fall. If the March 2nd priority deadline has passed, you should file the FAFSA or CADAA before the June 30th deadline.

- What is the School Code for Mt SAC?The code is: 001245

- Do I have to reapply for financial aid every year?Yes. The Free Application for Federal Student Aid (FAFSA) or CA Dream Act Application (CADAA) can be filed any time after October 1st for the coming academic year; the priority Cal Grant deadline is March 2nd. We recommend applying early to maximize your potential financial aid offers.

- Once I file my FAFSA, what happens next?Once you fill out your FAFSA or CADAA, your Student Aid Report (SAR) will be available online to review a summary of the information you provided on your FAFSA or CADAA. If you provided an e-mail address on your FAFSA or CADAA Application, you will receive an e-mail with a link to an online copy of your SAR. You should log into your Mt. SAC Portal to check your application status.

- Are there any other forms I need to fill out in order to apply for financial aid?The FAFSA or CADAA are the only applications you need to apply for federal and/or state financial aid at Mt. SAC. Once your FAFSA or CADAA has been processed, you might be asked to submit some additional forms and/or documentation to the Mt. SAC Financial Aid Office. These forms and/or documents are needed to complete your file. Community College students may apply for the Cal Grant Competitive Award by March 2nd or September 2nd . For State grants a GPA Verification Form needs to be completed. Since the number of awards available in September is limited, it is best to have your FAFSA and GPA Verification form in no later than the March 2nd deadline. To access a GPA Verification Form visit the California Student Aid Commission Website.

- What delays disbursement of financial aid funds?The following are reasons why the student's funds may not be available on the first day of classes:

- Having holds

- Not submitting and/or correctly completing required documents

- Not being enrolled

- Not making Satisfactory Academic Progress towards a degree or certificate

- Being in default on a student loan or owing a repayment to any Title IV financial aid program

- Not having an eligible program of study

What Does SAP Stand For?

- What are the office hours for the Financial Aid Office?Office hours are 8:00 a.m. - 7:00 p.m. Mon - Thurs., and 8:00 a.m. - 4:30 p.m. on Fridays. These hours are subject to change.

- If I am enrolled at two colleges, can I receive aid at both colleges?No, you cannot receive aid at more than one college for the same enrollment period.

- Is the FAFSA the only aid application I must fill out?

The FAFSA is the only form you need to complete to apply for Federal Student aid funds. Some colleges and State grant agencies may require supplemental data for awarding institutional and state funds. Any supplemental data must be collected on a separate form(s). You will not be charged a fee for processing and reporting data from the FAFSA but if you file a supplemental form, you may be charged a fee for processing and reporting data from it.

What is the FAFSA?

- How do I Apply?Apply online at https://studentaid.gov/. Applying online will reduce the errors through edit checks.

- Who can help me with questions about the application?Financial Aid Seminars are available at most colleges, check with the Financial Aid office for availability, dates and times.

- How do I make corrections?Use your SAR to correct information you submitted on your original FAFSA. Check with the college before you send the SAR back to the processor to confirm this is the action they recommend. Many colleges can process corrections for the students electronically. If filed on the web, you may make corrections electronically.

- I lost my SAR. How can I get another one?To request a duplicate SAR, call: 1-800-4FED-AID (1-800-433-3243); TTY Assistance at 1-800-730-8913.

- What is the income cut-off to qualify for financial aid?Financial Aid is available to students and their families who need assistance paying for education beyond high school. Some loans and scholarships are available regardless of "need".

- What if I don't have a Social Security number or don't want to report it on my financial

aid application?It is necessary to provide your Social Security number on the FAFSA. If you do not yet have a number, you should contact your Social Security Administration office to obtain one. It is required before you can be considered for any Federal student aid program. The FAFSA will be returned unprocessed if the student's Social Security number is blank.

For CA Dram Act Applicants, a Social Security number is not required to successfully complete and submit the application. However, if you are a CA Dream Act Applicant and have a Social Security number, you should provide it on your application. - I plan to go to college half-time. Will that lessen my chance for aid?Almost all funds are available to students who attend college at least half-time. Some institutions, however, give preference to full-time students. Some programs are available for less than half-time attendance.

- My neighbor and I both applied for financial aid at the same college. Why did she

get more aid than I did when they've got a bigger house than ours and their parents

make more money than mine?The circumstances in your neighbor's family may be different than they appear, and home equity is not used to determine eligibility for financial aid. What doesn't necessarily show are other factors, such as family size or number in college, which may affect the computation of the family contribution.

- What happens if I purposely provide inaccurate information and I'm caught?If you use the FAFSA or CADAA to apply for student financial aid funds and provide false information, you are subject to fines and/or imprisonment under the U.S. Criminal Code. State and local laws may also apply in such cases.

- I don't feel it is the college's right to request my tax forms. What happens if I

don't submit them?If you fail to comply with a request for tax forms, the college will not be able to complete and process your financial aid file. Consequently, you may not receive all the aid that you may qualify for.

- Must I be accepted for admission before I apply for financial aid? Must I be admitted

before I receive aid?You may apply for financial aid at the same time you apply for admission. Many colleges require that you be admitted before they offer aid. However, you must actually enroll in college to receive any funds.

- How do I get a tax transcript for a prior year tax return?